|

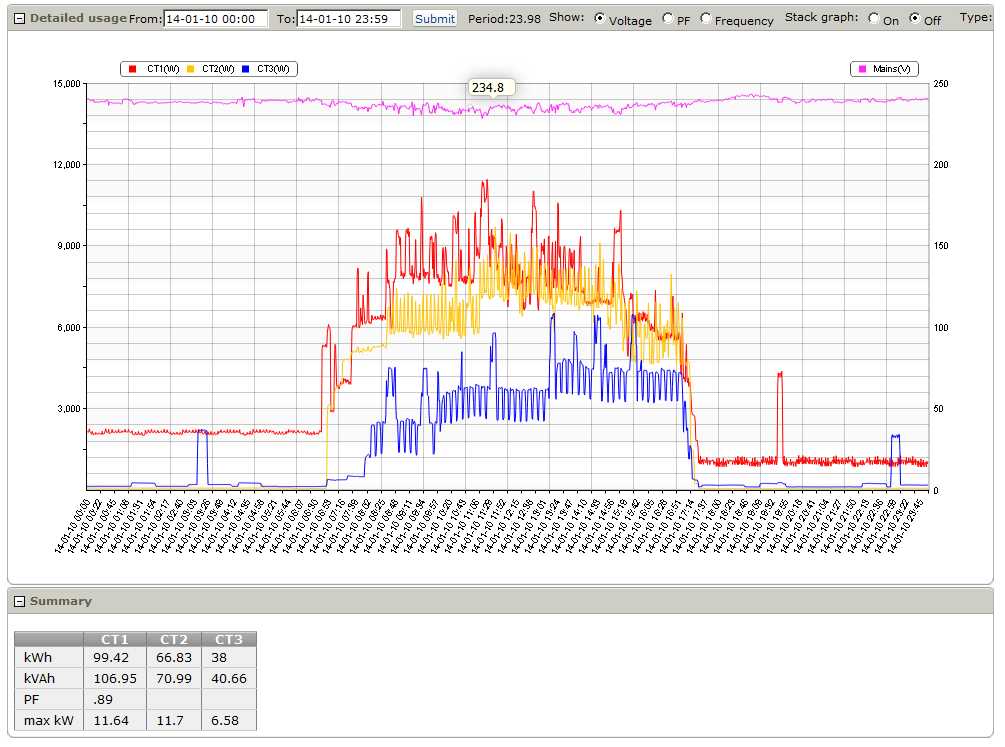

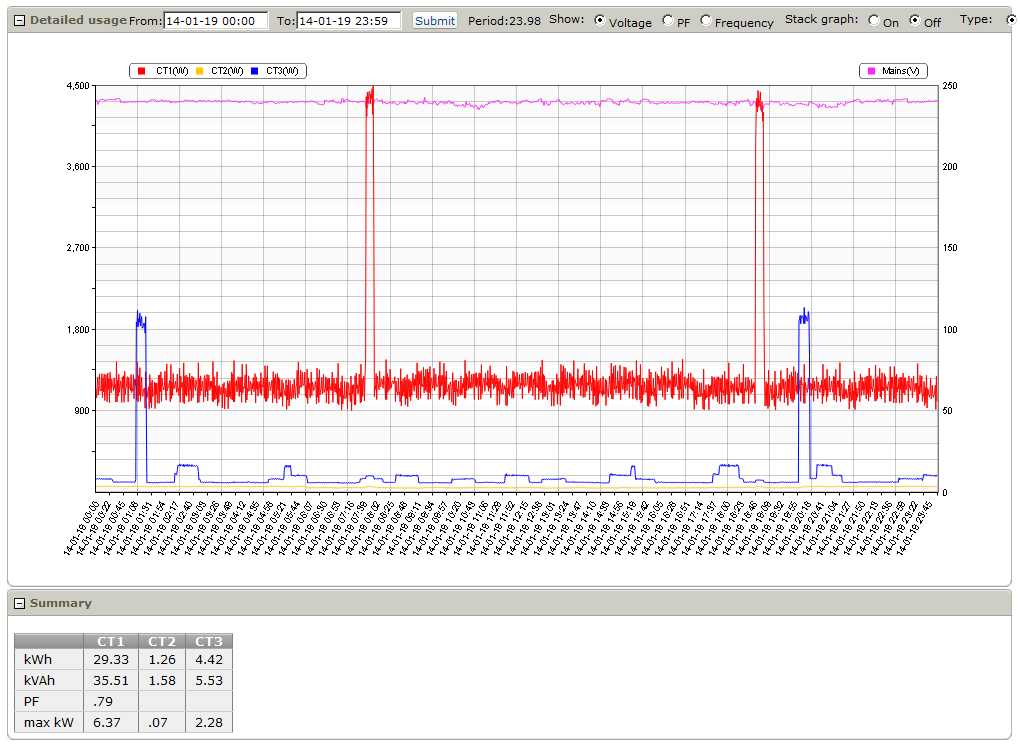

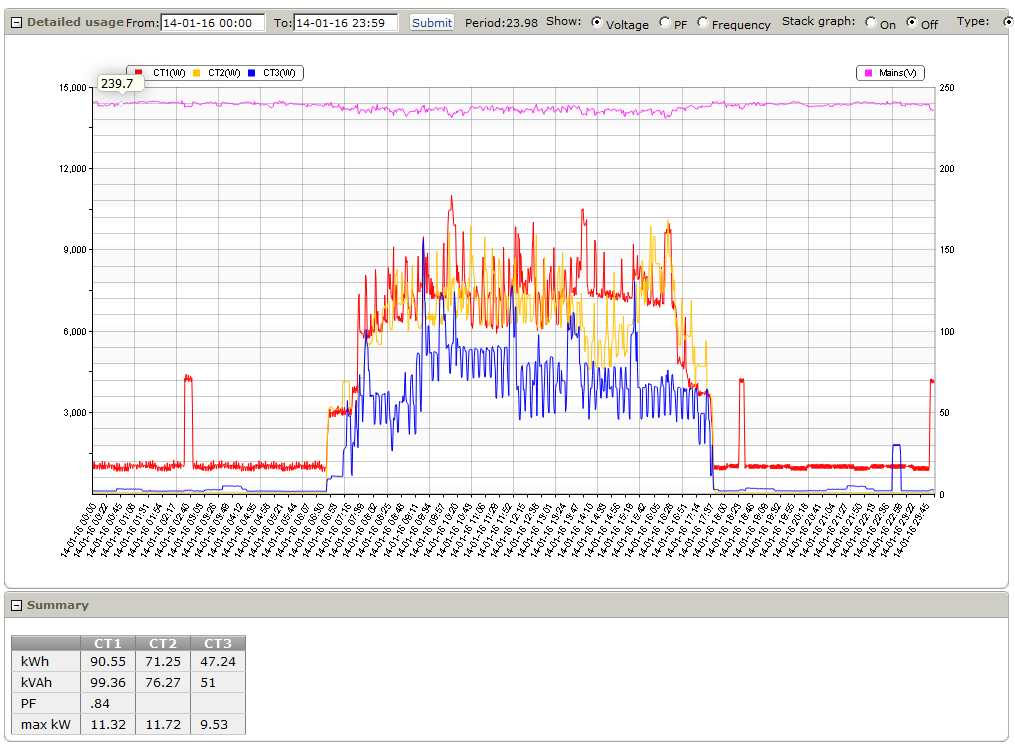

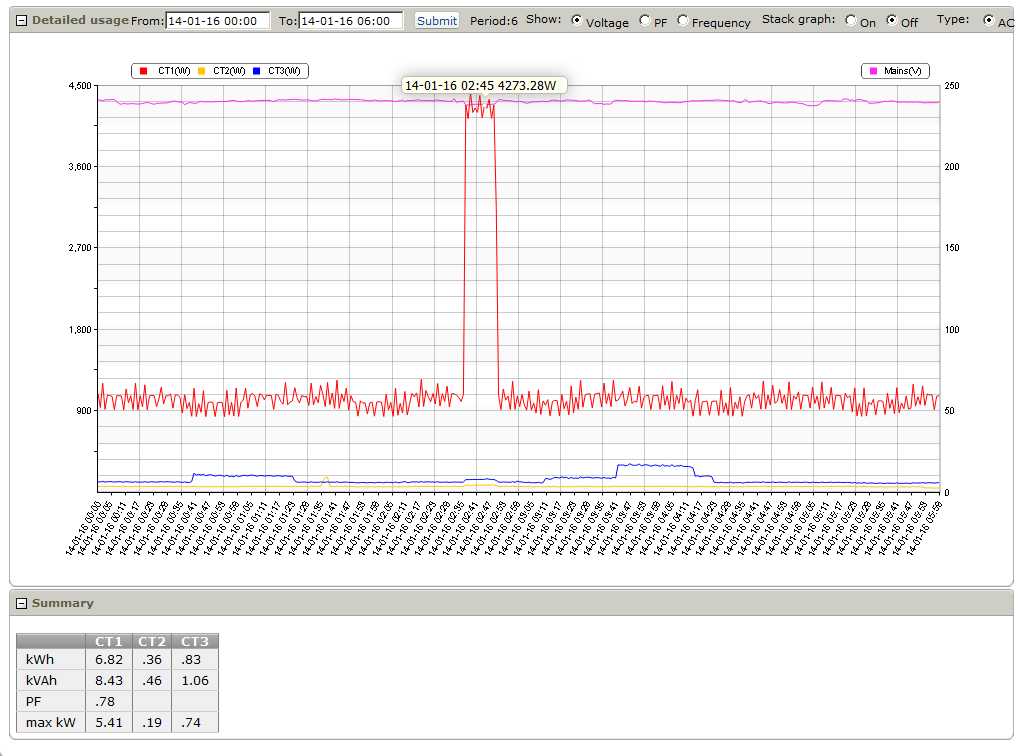

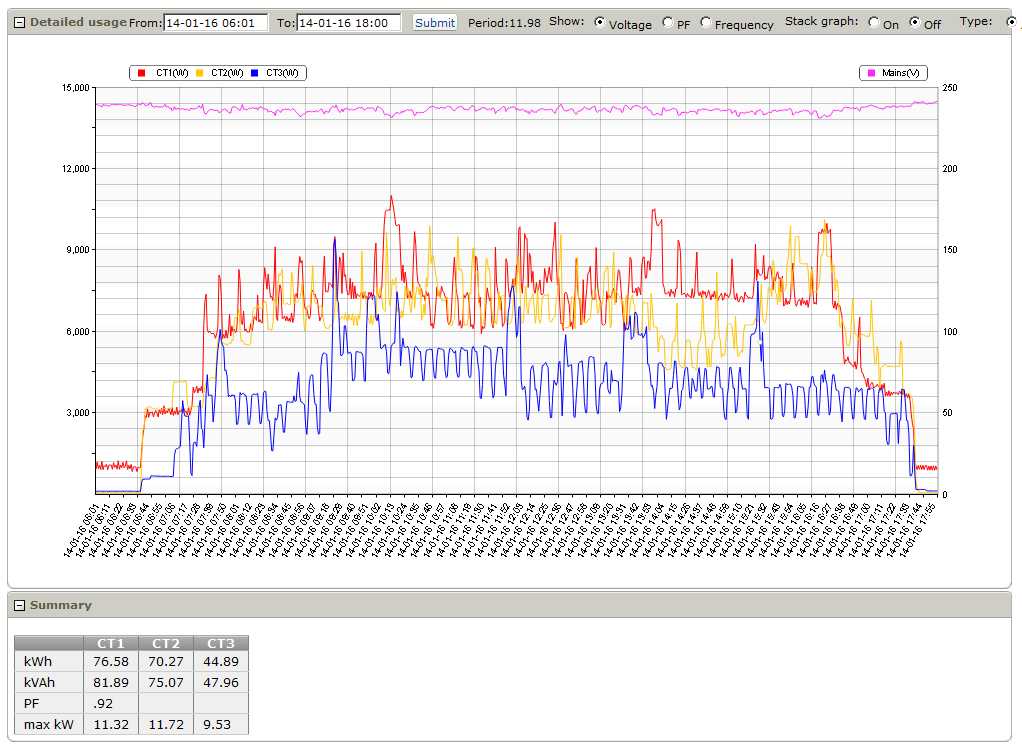

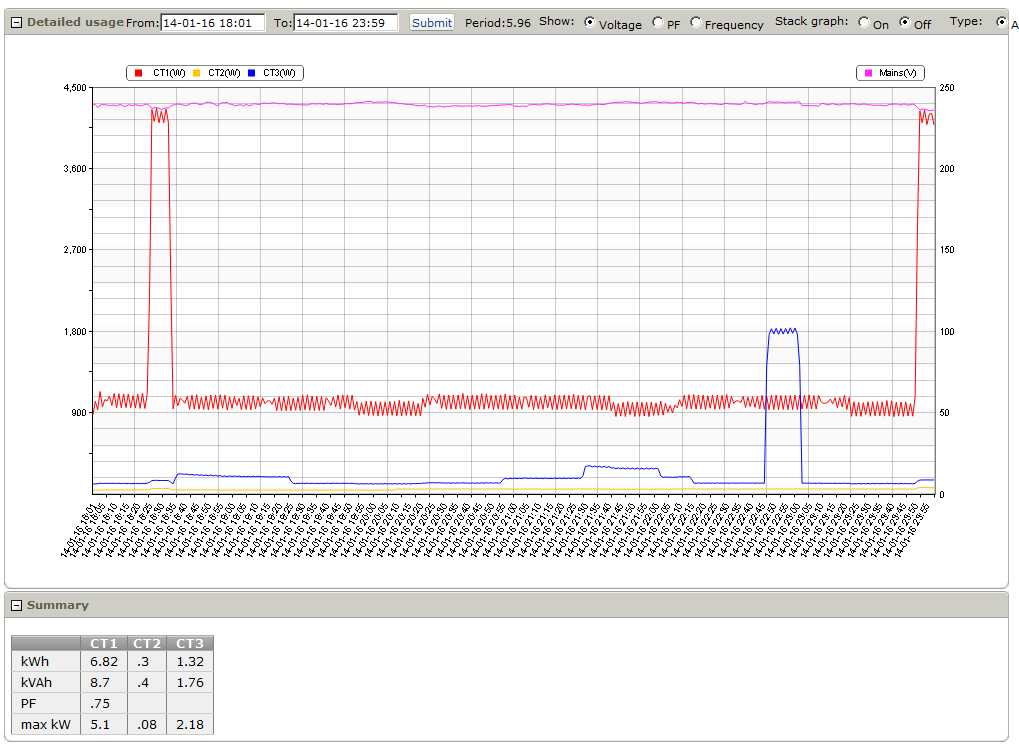

ExSolar can perform an energy audit at your premises by installing our very own Smart Energy Monitor for a period of time in order to monitor your energy usage. To get an efficient profile of your energy usage, we usually install the monitor for a week to two-week period. It is connected to our online webserver in order for us to track the data from any location with the access to the internet. Edit 22/01/24: Please note the ExSolar Smart Energy Monitor has been upgraded to the newer PiMX/GX device Please see the sample report below: Total Consumption for period 07-01-2014 to 24-01-2014 Total consumption for period shown 1967kWh (3-Phases combined) CT1 = Red Bar Graph = 1350kWh CT2 = Yellow Bar Graph = 963kWh CT3 = Blue Bar Graph = 653kWh The phases are hence fairly well balanced. Day of Most Usage (10-01-2014) (Friday) Day of Least Usage 19-01-2014 (Sunday) Day of Average Usage (day picked was 16-01-2014) (Thursday) Night Usage on Average Day (16-01-2014) Base Load is approximately 900W (red phase) Daytime Usage (06:01 to 18:00) on Average Day (16-01-2014) Peak load on red phase = approx. 11kW (red phase) Evening Usage (18:01 to 23:59) on Average Day (16-01-2014) Base load approximately 900W (red phase)

The above data is only a summary; full data is available online on the website with the accountset up for the customer. NOTE: Only Internet Explorer later than 9.3 will support the html5 canvas correctly. Otherwise anything else including ipad, iphone, Firefox, Chrome, Safari etc will work.

0 Comments

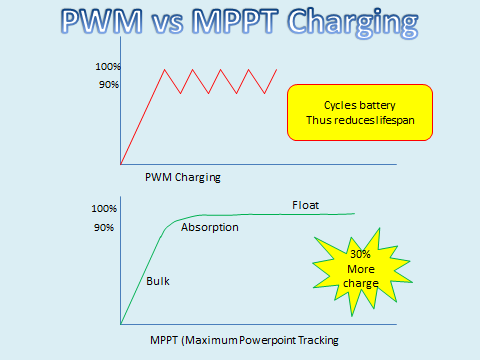

ExSolar recently installed a system for a unique project requiring mobile energy… This panel van belongs to Gaynor Schoeman who is a famous desert walker who’s plan is to cross the desert in this vehicle. She required the van to be reliant on alternative power sources in order for her to be self-sufficient with regard to power. The project planning started in December 2013 where discussions of fitting flexible panels to the vehicle where had, due to their length and efficiency a 150W panel was fitted on a Roof Rack system on top of the vehicle. This took some engineering to ensure that the panel would not take a pounding on dirt roads and desert dunes, a rubber shock system was installed by the ExSolar team to prevent the system from damage. This system allows Gaynor to have a second battery to run her Fridge, LED lights and inverter for a Laptop and other small appliances requiring 230V AC. A Cyrix 12/24v-120A Battery Combiner was fitted between the vehicle battery and the Lead Crystal Solar Battery. This unit allows the solar battery to be charged by the vehicle’s alternator whilst driving. When the vehicle is stationary and not charging via Solar, at night for example, only the extra solar battery will be discharged and will not discharge the vehicle’s main battery, thus allowing one to start ones vehicle even if the extra battery runs flat for what ever reason. This is the function of the Battery combiner, allowing discharge of the Lead Crystal Solar battery ONLY. This Victron Energy Cyrix system has an added BOOST! START Button function. Should ones main engine battery run flat for whatever reason and through no fault of the Solar system, one would be able to connect the solar backup battery through to the main battery for 30 seconds. This allows one to start the dead vehicle by using the extra battery. The main panel with all equipment installed. The main board was installed in a position that allowed ease of access and still allowing room for packing the vehicle in an efficient manner. The system has Solar fusing, Battery fusing as well as a remote switch running from the Victron 12V 350W inverter which cuts out the stand-by power of the inverter. The Victron inverter has a protection built in so that if two powerful devices are plugged in, the system will cut out. The solar panel and charging system: The solar panels charge through the Victron’s 15Amp 70V MPPT Controller (maximum power point tracker). This MPPT technology has two advantages. Firstly it does not, when the battery is full, switch off the panel and allow the battery to discharge, thus cycling the battery unnecessarily such as the old fashioned PWM charging. It does a bulk charge then slows the rate of charge down and then floats the battery even if the load should increase during the day. Secondly, the panel voltage is much higher than the battery voltage. MPPT technology does not just cut off the voltage to meet the battery’s voltage, it inserts the extra voltage in the form of amps instead thus giving 30% more charge to the batteries compared to old technologies. Ready to go solar system!

Very exciting project to power a beautiful charter yacht with a solar system of 1,5kW (12V).

ExSolar’s team installed the complete system to power the boat for the Madagascar diving and fishing charter tours. The system consisted of:

Encouraging efficient utilisation of energy through the Income Tax Act of 1962 section 12L

This article looks at what can be claimed, what is not claimable, who can issue reports and where to find these persons and companies, what should be on the certificate for SARS, the steps to start the claiming process, where to log your intention to start claiming tax, access to the relevant sourcing documentation, and workshops that are planned to communicate the requirements. The long awaited tax allowance for energy efficiency savings was promulgated during November 2013 with the effective date notified as 1 November 2013 and is set to provide impetus to the development of the energy efficiency and Measurement and Verification (M&V) industries in South Africa. This article looks at the Regulation dated 9 December 2013 and the requirements it sets for claiming an allowance for energy efficiency savings, as well as what is not claimable, in terms of section 12L of the National Treasury, Income Tax Act No. 58 of 1962. The Minister of Finance, Pravin Gordhan, in consultation with the Minister of Energy and the Minister of Trade and Industry, published the signed notice of the effective date of the Regulation in Government Gazette Notice no. 855 of 8 November 2013 as “Regulations in terms of Section 12L of the Income Tax Act, 1962, on the allowance for energy efficiency savings” and declared such to come into operation on 1 November 2013. More recently, on 9 December 2013 the said Regulation 12L was promulgated and stipulates the allowance is for the purpose of determining the taxable income derived by any person from carrying on any trade in respect of any year of assessment ending before 1 January 2020. It stipulates that there must be allowed as a deduction from the income of that person an amount in respect of energy efficiency savings by that person in respect of that year of assessment. It should be noted that ‘a person’ referred to in this instance is a tax entity and in effect means that the energy efficiency allowance is not restricted to any industry, sphere of business, or any project and specific energy efficiency initiative – in a nutshell, if you are paying tax you can claim the allowance within the boundaries stipulated in the 12L Regulation. The allowed deduction is calculated at 45c/kWh for verified energy efficiency savings. The most significant requirement to take cognisance of is that a baseline for the savings should be set by an M&V Professional under the auspices of an M&V Body accredited by SANAS in accordance with SABS/SANS 50 010:2011. With energy efficiency being an intangible commodity until it is assigned quantification through a protocol as within the M &V process, formalised in the M&V national standard SABS/SANS 50 010:2011, it is important to take cognisance of the definitions stipulated in the Regulation to logically separate what is part of the 12L allowance and what is not: “energy efficiency” means energy efficiency as defined in the standard; “energy efficiency savings” means the difference between the actual amount of energy used in the carrying out of any activity or trade, in a specific period and the amount of energy that would have been used in the carrying out of the same activity or trade during the same period under the same conditions if the energy savings measure was not implemented; This article should be read in conjunction with the references provided which refer to the applicable standards, regulations and approval documentation. 1. Background In 2009, the then Minister of Finance, Trevor Manuel, announced that there would be tax incentives for those that can demonstrate energy efficiency savings setting the ball in motion to employ the Income Tax Act of 1962 for this purpose. Such tax incentives have been offered since 2009 using section 12i, the Industrial Policy Project Investment incentive for manufacturing-related projects with a 10% energy demand reduction component. Shortly thereafter the proposed 12L ‘Regulations on the allowance for energy efficiency savings’ were released for public comment by 15 November 2011. The effective date of 1 November 2013 for the 12L Regulation was promulgated by the Minister of the Department of Energy (DoE), Minister Pravin Gordhan in the Government Gazette of 8 November 2013. The 12L Regulation was promulgated on 9 December 2013 in Government Gazette No 37136 and stipulates that there must be allowed as a deduction from the income of a person an amount in respect of energy efficiency savings by that person in respect of a year of assessment. The Regulation for 12L sets out the process and methodology for determining the quantum of energy efficiency savings, and requirements for claiming the proposed tax allowance, which stipulates a prerequisite that energy savings reports have to be compiled by M&V Professionals performing M&V under the auspices of a SANAS accredited M&V Body and the savings certified by South African National Energy Development Institute (SANEDI) through issuing of a certificate. To meet the requirements of 12L, government has provided a structure to implement 12L with technical support in the form of South African National Standards (SANS); assurance through the accreditation of energy efficiency M&V Bodies by the South African National Accreditation System (SANAS); and jurisdiction through SANEDI. The M&V industry have also taken the initiative to set up a Council for Measurement and Verification Professionals of South Africa (CMVPSA) to ensure that the standard of work performed by M&V Professionals are upheld to provide credibility to the industry and security of workmanship to clients, engage and advise decision-makers on M&V related matters, as well as advise and protect the member M&V Professionals. 2. The reasoning behind 12L According to the schedule of the Regulation, government recognises that it has become necessary to promote the efficient utilisation of energy to safeguard the continued supply of energy and to combat the adverse effects of greenhouse gas emissions related to fossil fuel based energy use on climate change. Saving energy through its efficient use may in government’s opinion also be considered as a potential successful method to guarantee the efficient utilisation of energy in future. The Regulation also throws some light on what the funds will be used for from the impending Carbon Tax to come into effect in January 2015 by stating that “the intended purpose of a carbon tax is to mitigate greenhouse gas emissions and also to utilise (recycle) some of the revenue to be generated from such a tax to finance incentives to advance the further efficient utilisation of energy”. If interpreted correctly, there is promise that government will be ‘recycling’ the carbon tax income towards financing some of the 12L energy efficiency tax allowance. Before discussing the processes for claiming incentives it would be good to look at the exclusions as, although they look quite minimal, a number of projects will be excluded and it is important to be aware of this before starting any process. 3. What is excluded from the 12L allowance 3.1 Renewable sources are excluded Regulation 6 depicts that a person may not receive the allowance “in respect of energy generated from renewable sources or co-generation, which means energy from waste and combined heat and power, other than energy generated from waste heat recovery”. The renewable sources excluded are listed as biomass, geothermal, hydro, ocean currents, solar, tidal waves or wind. Waste heat recovery is defined as “utilising waste heat or underutilised energy generated during an industrial process”. Therefore only energy generated using waste heat recovery may be considered. 3.2 Captive power plants allowance encourages self-generation on a large scale Generating energy for your own use is seen as a ‘captive power plant’ and an allowance can only be claimed should the “kWh or the equivalent kWh of energy output of the captive power plant” i.r.o. an assessment year is “more than 35% of the kWhs or the equivalent kWhs of energy input in respect of that year of assessment”. The definition in the Regulation stipulates that “A captive power plant means where generation of energy takes place for the purposes of the use of that energy solely by the person generating that energy”. This is interpreted as the self-generated energy, albeit from whichever source, is not being fed into the grid, but used within the reticulation system of the respective project or plant for which the energy efficiency allowance is being claimed. It is an incentive to up the implementation self-generation in excess of 35% of the requirements of a project or plant. This can be interpreted as an exception to the rule mentioned in 3.1 previously, where renewables is excluded from 12L, with the exception that if such renewable energy is generated for own use and if it constitutes in excess of 35% of the kWhs of energy input in the year of claiming, it will be allowed. 3.3 Concurrent benefits not allowed Any grant, allowance or similar benefit which is, or was received, for energy efficiency savings by any ‘sphere of government’, of any public entity that is listed in Schedule 2 or 3 to the Public Finance Management Act, 1999 (Act No. 1 of 1999) is excluded as per regulation 7. This means carbon credit offsets and letters of approval for CDM projects received from entities that constitute a ‘government sphere’ will not be allowed. Schedule 2 and 3 entities also constitutes a number of organisations that support the energy efficiency industry through grants and benefits ranging from the CSIR, which means the NCPC-SA and its IEE Project, Technology Innovation Agency (TIA), Central Energy Fund (CEF), Eskom, Industrial Development Corporation (IDC), Independent Development Trust, Land and Agricultural Development Bank of SA, Small Enterprise Development Agency, DBSA, EWSETA and many more. What is allowed is that a project that has already received a benefit, can be ring-fenced and removed from the equation during the M&V process so that the section of the plant or project which has not received any concurrent benefit can become eligible for the allowance. However, projects started before the effective date of 1 November 2013 do not qualify, only projects after this date. 4. Ensuring the viability of a 12L allowance claim With all the exclusions and concurrent benefits, the question arises what constitutes a viable opportunity to pursue the benefit of the energy efficiency tax allowance. A good starting point is to contact an M&V Professional to identify any current initiatives that do not fall within the concurrent benefit category and ensure that your project is large enough to make the M&V process and tax incentive financially viable. Remember, not only large full-scale electrical projects qualify, projects like lighting only, or the insulation of certain buildings on your premises, a major upgrade of airconditioning systems, or drives, even reducing diesel or coal use will qualify. In addition, except for the energy sources excluded in the limitations mentioned, all other energy sources can be claimed, for instance converting to gas from electricity because of its efficiency ensuring an energy saving, or using less fuel in a vehicle fleet due to implementing energy efficiency measures. A safe rule-of-thumb is if you can save 1GWh for an assessment year, 12L would most likely be a viable probability for you. 5. Stakeholders in the energy efficiency tax claiming process It is important to become familiar with the stakeholders involved in regulating and controlling the system to ensure accuracy, credibility and transparency, as well as understanding the requirements by each within the tax claiming process. STAKEHOLDERS AT A GLANCE * SANEDI: Evaluate M&V Professional’s energy savings reports and issue tax certificates to organisations for submission to SARS to claim section 12i and 12L tax incentives – www.saneditax.org.za <http://is.ss20.mailgm.com/sendlink.asp?HitID=1386679118251&StID=35690&SID=1 4&NID=582996&EmID=2220571&Link=aHR0cDovL3d3dy5zYW5lZGl0YXgub3JnLnphLw%3D%3D& token=7cfca8ca32e04998a458526998a3ff9c17ac4c2c> * SANAS: Accreditation of M&V Bodies – www.sanas.co.za <http://is.ss20.mailgm.com/sendlink.asp?HitID=1386679118251&StID=35690&SID=1 4&NID=582996&EmID=2220571&Link=aHR0cDovL3d3dy5zYW5hcy5jby56YS8%3D&token=7cfc a8ca32e04998a458526998a3ff9c17ac4c2c> * SARS and National Treasury: Financial incentive provider using the normal annual tax return process * CMVPSA: Although this is a voluntary membership-based body, it houses the contact information of screened M&V Professionals and takes on the role of ensuring a capable, credible, transparent and efficient M&V workforce for South Africa – www.cmvpsa.org.za <http://is.ss20.mailgm.com/sendlink.asp?HitID=1386679118251&StID=35690&SID=1 4&NID=582996&EmID=2220571&Link=aHR0cDovL3d3dy5jbXZwc2Eub3JnLnphLw%3D%3D&toke n=7cfca8ca32e04998a458526998a3ff9c17ac4c2c> 6. Procedure for claiming the tax allowance The Regulation stipulates that organisations wishing to claim an energy efficiency tax allowance according to the 12L Regulation should take the following steps: 1. Register with SANEDI for energy efficiency tax allowance claims at www.saneditax.org.za 2. Appoint an M&V Professional, from a SANAS accredited M&V Body, to compile a report containing a computation of the energy efficiency savings in respect of that person for that year of assessment. 3. Submit the M&V Professional’s report to SANEDI. 4. SANEDI will furnish you with the approval for continuance. 5. On the successful completion of the energy efficiency savings project and the tax allowance approval process SANEDI will issue a formal energy savings certificate. 6. Submit the certificate to the South African Revenue Service (SARS) together with the claim for the tax allowance as part of the customary tax returns. This is the process for each year of assessment for which the allowance is claimed, for each project. To find an M&V Body visit the SANAS website: www.sanas.co.za, <http://is.ss20.mailgm.com/sendlink.asp?HitID=1386679118251&StID=35690&SID=1 4&NID=582996&EmID=2220571&Link=aHR0cDovL3d3dy5zYW5hcy5jby56YSUyQy8%3D&token= 7cfca8ca32e04998a458526998a3ff9c17ac4c2c> under the page ‘Accredited Facilities’ and search for ‘Measurement and Verification’ under the ‘Inspection Body’ category. To find an M&V Professional visit the CMVPSA website: www.cmvpsa.org.za <http://is.ss20.mailgm.com/sendlink.asp?HitID=1386679118251&StID=35690&SID=1 4&NID=582996&EmID=2220571&Link=aHR0cDovL3d3dy5jbXZwc2Eub3JnLnphLw%3D%3D&toke n=7cfca8ca32e04998a458526998a3ff9c17ac4c2c> , search under ‘membership’ for Provisional Full Members, these are the persons qualified to perform M&V work if they are incorporated under an M&V Body – note not all members are recognised, only Provisional Full Members, and Full Members. 7. Annual claiming cycle The M&V Professional’s report contains a computation of energy efficiency savings i.r.o the tax entity for the year of assessment and is done in accordance with the SANS standard and the baseline requirements therein. The Regulation requires the baseline to be set for the year in which the allowance is claimed and must be adjusted for every year of further assessment. The methodology used to determine the baseline must be in accordance with the standard and the baseline must be derived from data gathered during the year of assessment, preceding the first year of assessment for which the allowance is claimed. Green field projects also qualify where the baseline can be constructed from comparable data in a relevant sector, using the SABS/SANS 50010:2011 standard. The annual term of assessment is dependent on the claimant’s financial year-end, and in the case of green field projects, the time of commissioning of the energy efficiency project. More than one project can be claimed within a cycle as well, it is not restricted to plant- or company-wide consumption only. 8. Independence and impartiality of M&V reports To ensure impartiality and independence, accredited M&V Bodies need to manage the risks posed by utilising impartial and independent M&V Professionals. Part of the SANAS accreditation assessment process will include checking for independence and impartiality. These accredited bodies are liable for the results of M&V reports produced by M&V Professionals working under their auspices for a period of 7 years. M&V Reports are only accepted if done under the auspices of an accredited M&V Body, as per SANAS requirements, by an M&V Professional. Such Inspection Bodies are accredited in terms of section 22 of the Accreditation for Conformity Assessment, Calibration and Good Laboratory Practice Act, 2006 (Act No. 19 of 2006), for the purposes of inspection, measurement, reporting and verification of energy efficiency savings. True M&V Bodies and their M&V Professionals are trained and qualified to perform these functions, they are also assessed by SANAS assessors to ensure that they are capable of performing the required reporting tasks in accordance with SANAS and SANS requirements. 9. Sub-contracting M&V work by M&V Bodies The SANAS Technical Requirements (TR81-03) stipulate that an M&V Body may sub-contract M&V Professionals, or service providers, to perform work on their behalf in instances where the M&V Body is overloaded, have incapacitated staff, unfit equipment and if it is out of the scope of expertise which lies within the M&V Body. To ensure transparency the M&V Body has to inform the customer in writing of its intention to subcontract the work in question and the customer must agree to this. One of the requirements if ISO/IEC 17020 is that a register be kept by each accredited M&V Body containing the names of facilities it may select to subcontract to. It is the M&V Body’s responsibility to ensure that the subcontractor complies with all the accreditation requirements as it remains accountable for all work done under its auspices. Irrespective of this arrangement, the M&V Professional that signs off on the formal savings report also needs to be an approved SANAS Technical Signatory as part of the accredited M&V Body. An M&V Professional in the employ of the customer may not be viewed as an impartial person to sub-contract work to, unless that person is a specialist in the scope of work required for the purposes of issuing an accurate M&V Report. The M&V Body will then be at risk of utilising a sub-contracted service that might be viewed as not being impartial or independent, therefore, such a decision would be left to the M&V Body to assess the required needs for impartial and transparent reporting and SANAS finding it acceptable when assessing the M&V body. 10. SANEDI’s claiming process and certificate Reports submitted to SANEDI must contain satisfactory information which complies with the standard, is an accurate reflection of the energy efficiency savings of the person claiming the allowance in respect of the year of assessment for which the allowance is claimed; and complies with the 12L Regulations with a baseline and measurements done in line with the standard. SANEDI issues a certificate containing the information for the assessment year of which the claim is made which must be verified and done in accordance with the standard: * The baseline at the beginning of the year of assessment in accordance with regulation 5. * The reporting period energy use at the end of the assessment year. * The savings in kWhs or equivalent for the claim. * For captive power plants, the difference between the kWhs equivalent of energy input and the kWhs equivalent of energy output. * The M&V Body’s name, accreditation number and the M&V Professional’s details. * The name and tax number of the person to whom the certificate is issued. * Date of the certificate, and the relevant certificate number. SANEDI may investigate or cause, to investigate any energy savings claimed to be satisfied that the saving is a true and accurate reflection of the savings achieved. To start the process with SANEDI, register your intention to claim online at www.saneditax.org.za <http://is.ss20.mailgm.com/sendlink.asp?HitID=1386679118251&StID=35690&SID=1 4&NID=582996&EmID=2220571&Link=aHR0cDovL3d3dy5zYW5lZGl0YXgub3JnLnph&token=7c fca8ca32e04998a458526998a3ff9c17ac4c2c> This certificate is the document accepted by National Treasury i.r.o. the requirements for claiming a deduction on taxable income in accordance with 12L. 11. Ensuring a controlled M&V industry to protect customers To ensure that M&V services and service providers are credible, trustworthy and transparent an independent Professional Body was established in the form of the CMVPSA, a chapter of the Southern African Association for Energy Efficiency (SAEE). The CMVPSA exists to protect the interests of all M&V stakeholders and the CMVPSA was established to take on the responsibility of registering, governing M&V Professionals as well as assisting in the supply and development of the technical expertise required to perform acceptable M&V in South Africa. SANAS accredits the M&V Bodies, whereas CMVPSA takes responsibility for the technical competency through registering qualified and suitably trained M&V Professionals, who perform the M&V for the energy saving reports under the auspices of an Accredited M&V Body. As the nature of claiming incentives for energy savings depicts that a claim is made for a measured void, or a measure which does not exist anymore, internationally accepted methodologies are applied to ensure accuracy. These methodologies are locally standardised through SANS 50 010:2011, the “Measurement and verification of energy savings” standard, and is a prerequisite for claiming tax incentives. CMVPSA considers application for registration from applicants who can prove that they passed the relevant M&V qualifications (e.g. Certified Measurement & Verification Professionals (CMVPs)), have the required experiential background and fullfil the academic requirements as set by the CMVPSA. More details are available from the CMVPSA website www.cmvpsa.org.za. <http://is.ss20.mailgm.com/sendlink.asp?HitID=1386679118251&StID=35690&SID=1 4&NID=582996&EmID=2220571&Link=aHR0cDovL3d3dy5jbXZwc2Eub3JnLnphLi8%3D&token= 7cfca8ca32e04998a458526998a3ff9c17ac4c2c> 12. M&V as a career path It is anticipated that a variation of types of M&V Professionals and Bodies will be essential in future, with a healthy mix of qualification levels and experiential requirements. From Registered Certified M&V Professionals regulated and governed by the CMVPSA or similar bodies to industry specialists for specific technologies, energy sources, and market sectors that could provide the services required to perform M&V. The M&V scope ranges from M&V of specialised projects like building insulation, lighting, pumping, control systems, etc . for a range of technologies in the industrial, residential, commercial and transportation sectors, as well as the array of energy sources like liquid fuel, fossil fuel, renewables, bio-fuel, etc. SANAS provides allowance for Accredited M&V Bodies to sub-contract some specialised services, or additional resources and expertise, to perform M&V obligations, with the condition that the sub-contractor’s competence can be verified and demonstrated with the M&V Body taking full accountability. A variety of resources is essential for good M&V which poses further opportunities. These include but are not limited to the development, supply, delivery, installation and maintenance of various types of calibrated measurement equipment, data acquisition/storage/management, training, experiential learning or coaching, assessors, data assurance auditing, forensic auditing, etc. It should be noted that a technical qualification may not be a prerequisite in all instances. Knowledge on M&V and energy efficiency in general, on all levels, will become more sought after throughout industry and therefore holds good opportunities for those interested. The credibility of reported energy savings and claims made are absolutely critical. The skills and knowledge required to ensure that this credibility is built into all processes and activities, opens up a new world of opportunities to many, who have the various levels and types of qualifications. The green economy in itself will only grow, making M&V more important, going forward. Persons wishing to enter the M&V sector can attend training provided by approved training providers such as the American Association of Energy Engineers (AEE) in conjunction with the Energy Training Foundation (ETF) and the Southern African Association for Energy Efficiency (SAEE). Registration with CMVPSA is conditional to the successful completion of prescribed courses and examinations. Registration with CMVPSA is also subject to evaluation of practical M&V experience. 13. Conclusion With the M&V industry being propelled forward through releasing the tax allowance for energy efficiency savings, it is realised that successful implementation of 12L and growing the M&V industry as a whole to benefit future financial investments into energy efficiency savings, will need thorough communication. To assist with information dissemination the CMVPSA, through its parent body the SAEE, will facilitate on behalf of Government and the relevant Government Agencies, a number of workshops throughout the country to present details, supply information and address any questions. The schedule of dates for the workshops is as follows: * 27 Jan 2014, Pretoria * 28 Jan 2014, Durban * 29 Jan 2014, Port Elizabeth * 30 Jan 2014, Cape Town * 4 Feb 2014, Bloemfontein * 5 Feb 2014, Kimberley * 7 Feb 2014, Polokwane * 13 Feb 2014, Potchefstroom Workshops are free of charge with limited seats and can be booked by contacting SAEE office at [email protected] to secure a personal invitation to be forwarded to you. Registration will be open two weeks prior to the road show. 14. Acknowledgements Acknowledgement is granted to the following persons whom assisted with providing information to prepare the article: Barry Bredenkamp, Linda Grundling, Karel Steyn, Christo van der Merwe, Gustav Radloff. 15. Bibliography [1]National Energy Act 2008 (Act no. 34 of 2008), Schedule 2 and 3 organisations. [2]Income Tax Act of 1962 (Act no. 58 of 1962) section 12L. [3]SANS 50 010:2011, “The measurement and verification of energy savings”, founded on international best practice and is based on the International Performance and Measurement and Verification Protocol (IPMVP). [4]Income tax-based Industrial Policy Project investment incentive, introduced in the 2008 Revenue Laws Amendment Act (Act no. 60 of 2008), promulgated as section 12i of the Income Tax Act of 1962 on 8 January 2009. [5] Notice of the date upon which section 12L of the Income Tax Act comes into operation, Government Gazette Notice no. 37019, National Treasury, 8 November 2013. [6]De Lange Y. “EE tax allowances” Jan 2012, www.eandcspoton.co.za [7]Accreditation for Conformity Assessment, Calibration and Good Laboratory Practice Act, 2006 (Act No. 19 of 2006), Section 22. [9] SANAS TR81-03, “Technical requirements for the application of SANS/ISO/IEC 17 020:1998 in the assessment of inspection PV solar panels replaced the solar water heating panels.

The system consisted of:

|

AuthorsMarketing Manager for ExSolar Solar Solutions Archives

May 2024

|